Certificate IV in Accounting and Bookkeeping

QUALIFICATION OVERVIEW

General Information

| NAME OF RTO |

VOCATIONAL SKILLS AUSTRALIA(VSA) |

| RTO Code |

45121 |

| CRICOS Course Codes |

110021B |

| Training Package |

BSB Business Services Training Package (BSB |

| Qualification Title |

FNS40222 Certificate-IV in Accounting |

| Duration |

52 Weeks (One year) |

| Delivery mode |

This program is delivered in classroom |

| Authorized By |

Amir Salim |

| Contact Details |

info@vsa.sa.edu.au |

Qualification Description

This qualification reflects the role of individuals in the accounting and bookkeeping industry, including business activity statement (BAS) agents and contract bookkeepers; and of those employees performing bookkeeping tasks for organisations in a range of industries. It includes preparing and lodging business and instalment activity statements, data processing, monthly reconciliations, preparing budgets, preparing reports on financial performance and the position of the business, preparing end-of-year adjustments, and finalising financial records after year-end. Dealing with the Commissioner of Taxation on behalf of a taxpayer in relation to activity statements and other lodgement matters is also a key component of the role that this qualification reflects. Individuals in these roles apply theoretical and specialist skills and knowledge to work autonomously, and exercise judgement in completing routine and non-routine activities.

Packaging Rules

Ten (10) core and three (3) elective units are required for the award of the Certificate IV in Accounting and Bookkeeping. Units have been selected in accordance with the packaging rules and are relevant to the work outcome, local industry requirements and qualification level.

The latest release of the qualification and packaging rules can be found at the following link:

training.gov.au/Training/Details/FNS40222

Learner Characteristics and Target

Target groups for the FNS40222 Certificate IV in Accounting and Bookkeeping are international students who are:

- Seeking to pursue a career in business.

- Seeking to enter a new industry sector.

- Seeking a pathway to higher-level qualifications.

Characteristics of the target group are as follows:

Students will usually be new entrants. However, credit and/or RPL can be provided for those with existing skills and knowledge allowing such students to complete the course in a shorter timeframe.

Students will be from a range of countries and may be living in Australia for the first time or may have been here in the recent or more distant past.

Many will speak English as a second language, although an entry level has been set to ensure students are able to complete course work.

Students are expected to typically fall into the age range of 18 – 35 as people still establishing or changing careers.

Pathways

Potential employment options are in accounting roles

Students who complete this course may wish to continue their education into the FNS502122 Diploma Accounting or a range of Diploma qualifications related to accounting.

Course Credit/RPL

Students may apply for recognition of existing qualifications or skills, knowledge, and experience (credit transfer or recognition of prior learning). The granting of course credit may affect course fees as well as the duration of the course.

This process is outlined in VSA International Enrolment Policy and Procedures and in Recognition of Prior Learning (RPL) and Credit Transfer Policy and Procedure.

COURSE STRUCTURE & DELIVERY

Units of Competency

| UNIT CODE |

UNIT NAMES |

CORE OR ELECTIVE |

| BSBTEC302 |

Design and produce spreadsheet |

Core |

| FNSACC321 |

Process financial transactions and extract interim reports |

Core |

| FNSACC322 |

Administer subsidiary accounts and ledgers |

Core |

| FNSACC412 |

Prepare operational budgets |

Core |

| FNSACC414 |

Prepare financial statements for non-reporting entities |

Core |

| FNSACC418 |

Work effectively in the accounting and bookkeeping industry |

Core |

| FNSACC421 |

Prepare financial reports |

Core |

| FNSACC426 |

Set up and operate computerised accounting systems |

Core |

| FNSTPB411 |

Complete business activity and instalment activity statements |

Core |

| FNSTPB412 |

Establish and maintain payroll systems |

Core |

| BSBTEC402 |

Develop and use complex spreadsheets |

Elective |

| BSBWRT311 |

Write simple documents |

Elective |

| BSBCMM411 |

Make Presentation |

Elective |

Qualification and Statement of Attainment

Students will be required to achieve competency in all the above-mentioned unit of competencies to successfully achieve qualification of FNS40222 Certificate-IV in Accounting and Bookkeeping. A statement of attainment is issued if completion of units is less than the above required unit of competencies.

Fees for the Qualification

The total fee for the qualification includes:

- Enrolment fee: $250 (non-refundable)

- Tuition fees: $9,750 (this includes all course materials)

Vocational Skills Australia does not require international students to pay more than 50% of course fees prior to course commencement. However, Vocational Skills Australia provides students with the opportunity to pay more than 50% of their tuition fees prior to course commencement if they wish. The dates and amounts of fees are included in the Course Acceptance Agreement (payment Schedule)

Non-tuition fee/additional charges may apply and include:

| TYPE OF CHARGE |

AMOUNT |

| Application Fee |

$ 250 (non-refundable) |

| National Recognition (Credit Transfer) |

No charge / Nil |

Recognition of Prior Learning (RPL):

Application Fee; and

Assessment Fee per unit of competency |

$250.00

$250.00 |

| Reassessment (per Unit of Competency assessment) |

$200.00, applicable if “Not Satisfactory” Outcome after two consecutive attempts |

| Reprint of Statement of Attainment |

$50.00 |

| Reprint of Testamur |

$50.00 |

| Photocopying |

50C per black & white

photocopy single side |

| Printing: Black and White. |

50C per black & white

photocopy single side |

| Reissue of Student Card |

$50.00 |

| Issue of Letter for Immigration |

$25.00 |

| Interim Record of Results |

$25.00 |

| Cancellation Fees |

$250.00 |

| Bank dishonour fee |

$100.00 |

| Laptop\Chrome Book (If required by Learner) |

$305.00+ Additional warranty cost for 1 year if required by learner |

| National Recognition (Credit Transfer) |

No Charge/NIL |

| Debt collection |

$500.00 |

| Late Payment Fee |

10 % may be charged if payments is made after due date |

Delivery and Assessment Overview

The qualification is delivered over 52 weeks comprising of:

- 4 terms of 10 weeks each (40 weeks total).

- Holiday breaks amounting to 12 weeks (as specified in the timetable)

Students are required to attend 20 hours of classroom training per week.

Homework is expected to be approximately 5 hours a week.

The training and assessment schedule shows the weeks during which training is delivered and assessment conducted for each unit.

The total amount of training provided being structured classroom sessions is 540 hours. Time scheduled for assessment in class is 260 hours. Homework is unsupervised and may include research for assessments and general reading, as well as completion of the self-study activities is expected to be on average 5 hours a week.

Total delivery and assessment hours therefore amount to 800 hours and the volume of learning (i.e., including unsupervised learning of homework) is 1,000 hours. A detailed breakdown of hours is provided in the Training and Assessment Schedule.

| Volume of Learning |

Total Hours |

| Classroom Training Hours |

540 |

| Classroom Assessment Hours |

260 |

| Unsupervised Study Hours |

200 |

| Total Hours |

1,000 |

Vocational Skills Australia has decided on the course duration and amount of training considering the AQF Volume of Learning, which is typically 0.5 – 2 years and 600 – 2400 hours. It is considered that the duration and amount of training provided will allow international students the opportunity to fully absorb the required knowledge, as well as develop skills over time. This amount is not reduced to account for existing competencies, as most learners will not have any prior relevant experience. However, where learners have prior skills and knowledge, they may apply for RPL or credit transfer, which will reduce the course duration if granted.

Vocational Skills Australia operates a system of rolling enrolments meaning that students may commence at the beginning of any unit. Students may enter the qualification after any unit, as there are no pre-requisites for any units. The Training and Assessment Schedule is shown in terms, and this represents the scheduling of units on commencement. However, depending on when a student joins the course, the term number will vary.

Entry Requirements

There are no entry requirements under the training package.

Vocational Skills Australia has the following entry requirements: International students must:

- Be at least 18 years of age and have completed Year 12 or equivalent.

- Participate in a course entry interview to determine suitability for the course and student needs and to check the GTE requirements.

- Have an IELTS* score of 5.5 (test results must be no more than 2 years old). English language competence can also be demonstrated through documented evidence of any of the following:

- Educated for 5 years in an English-speaking country; or

- Successful completion of minimum of (10 to 20) weeks of ELICOS with any provider before commencement of studies with VSA

Student visa

*Note that other English language tests such as PTE and TOEFL can also be accepted. Students are required to provide their results so that it can be confirmed they are equivalent to IELTS 5.5. refer the below link for equivalent scores of different English language test providers

Student visa

Language, Literacy, and Numeracy

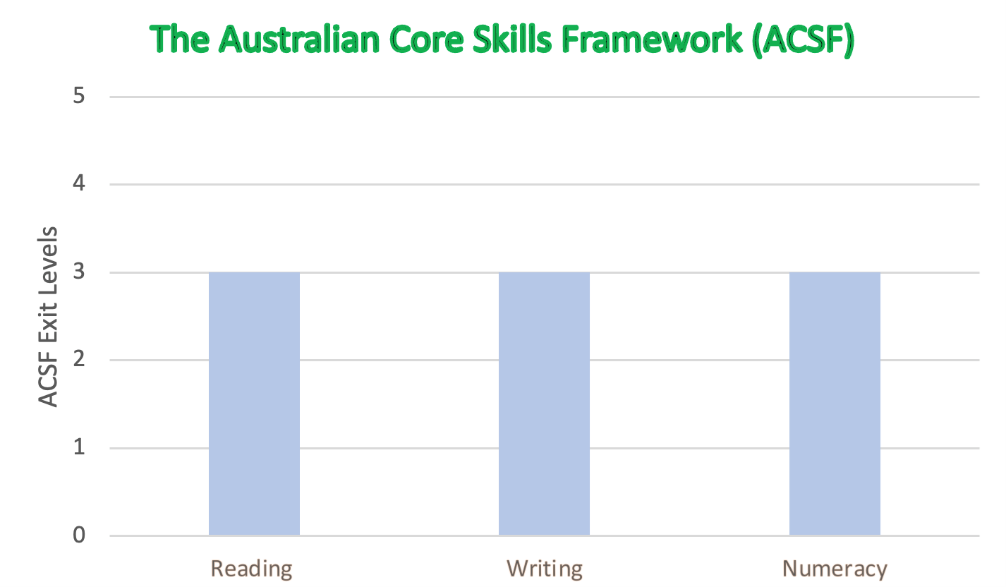

Students will complete an LLN assessment Core Skills Profile for Adults (CSPA) using the ACER test as part of the enrolment process. This ensures that the course is at an appropriate level for students and educational support is provided. The following levels provide a guidance of acceptable levels to ensure that the course is at an appropriate level for the student:

If the above review determines the applicant score are less than the desired levels, VSA staff will discuss further options with the applicant for LLN requirements.

Support Arrangements

Vocational Skills Australia provides learning and welfare support to ensure a supported and successful learning environment for all students. Support arrangements are detailed in the Educational & Support Services Policy and Procedures and details of all student support services are included in the Student Handbook and provided to students at orientation. Students’ course progress is monitored throughout the course as per our Course Progress and Intervention Policy and Procedures.